does texas have an inheritance tax 2019

However residents may be subject to federal estate tax regulations. New Jersey finished phasing out its estate tax last year and now only imposes an inheritance tax.

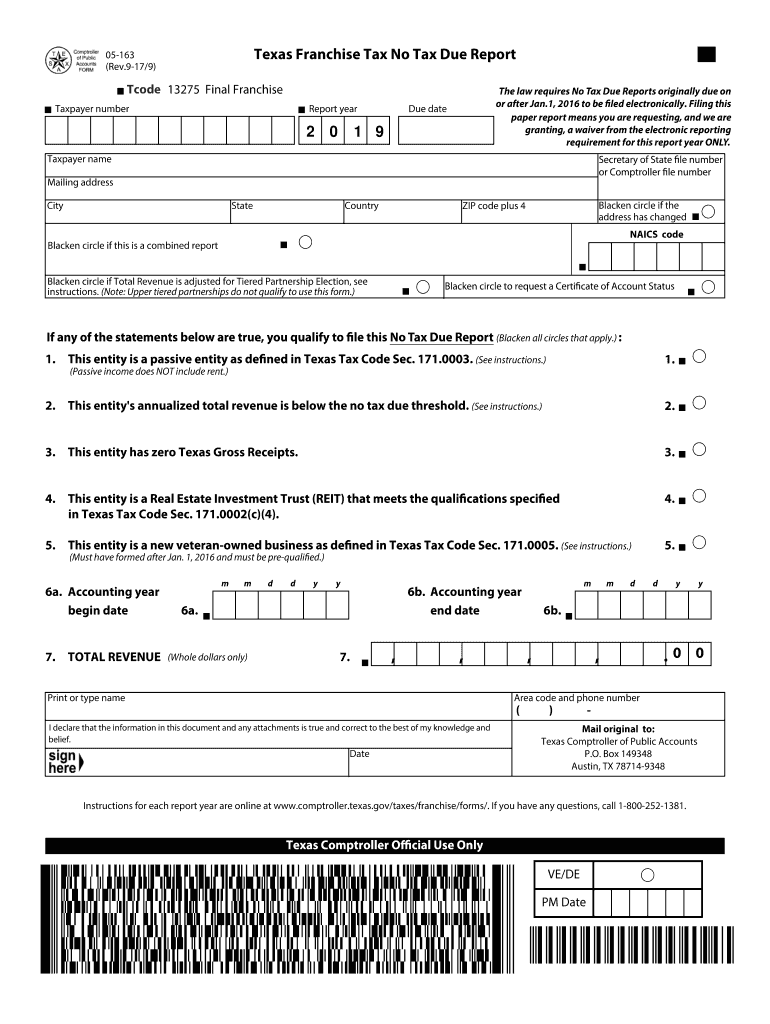

No Tax Due Report Texas 2019 Fill Out Sign Online Dochub

Texas does not have an inheritance tax.

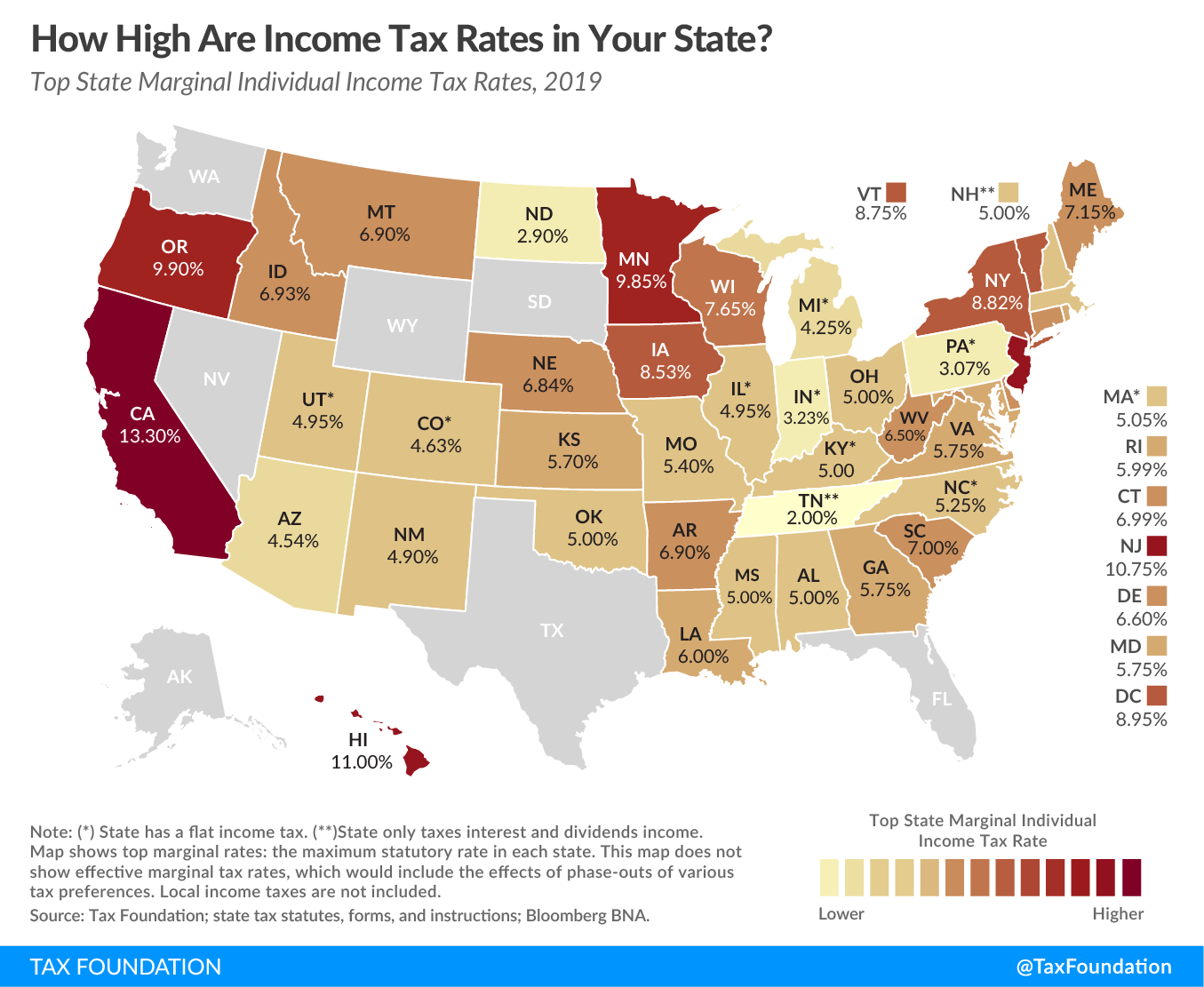

. The sales tax is 625 at the state level and local taxes can be added. Does Texas Have Inheritance Tax 2019. As of 2019 only twelve states collect an inheritance tax.

The Inheritance tax in Texas. Alaska is one of five states with no state sales tax. The top estate tax rate is 16.

Does texas have an inheritance tax 2019 Thursday March 3 2022 Edit. The top estate tax rate is 16. This is because the amount is.

Right now there are 6 states that have an inheritance tax. Higher rates are found in locations that lack a. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax.

There is a 40 percent federal tax however on estates over 534. Does texas have an inheritance tax 2019. Minnesota has an estate tax for any assets owned over 2700000 in 2019.

States With An Inheritance Tax Recently Updated For 2020 States With No Estate Tax Or. Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas. Texas has no income tax and it doesnt tax estates either.

The state of Texas is not one of these states. As of 2019 only twelve states collect an inheritance tax. Before breathing too big a sigh of relief Texan beneficiaries need to be aware that although Texas has no inheritance tax assets may still be subject to state inheritance taxes.

In the Tax Cuts and Jobs Act the. Its inheritance tax was repealed in 2015. There is a 40 percent federal tax however on estates over.

Delaware repealed its estate tax in 2018. 1 a capital gains tax is a tax on the proceeds that come from the sale of. This means that if you have 3000000 when you die you will get taxed on the 300000 over the.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. 1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas.

The article will guide you if you are considering real estate. Texas has no income tax and it doesnt tax estates either. However a Texan resident who inherits a property from a state that does.

However localities can levy sales taxes which can reach 75. There is also no inheritance tax in Texas. As of 2019 only twelve states collect an inheritance tax.

On the one hand Texas does not have an inheritance tax. But 17 states and the District of Columbia may tax your estate an. The federal government of the United States does have an estate tax.

What Is Inheritance Tax And Who Pays It Credit Karma

Corporate Income Taxes Urban Institute

When To Choose Munis From Outside Your Home State Charles Schwab

Breaking Down The Oregon Estate Tax Southwest Portland Law Group

Texas Estate Tax Everything You Need To Know Smartasset

Steven Schwartz Author At Black Probate Estate Administration Attorney Houston Texas The Schwartz Law Firm Houston Texas Page 2 Of 3

/https://static.texastribune.org/media/files/61547f1921b04a2c1250b7229511a4bb/2022Elections-constituional-lead-v1.png)

Texas Proposition 1 And Proposition 2 Explained What S On Your Ballot The Texas Tribune

What Is The U S Estate Tax Rate Asena Advisors

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

Does Your State Have An Estate Tax Or Inheritance Tax Tax Foundation

Us State Tax Planning Gfm Asset Management

/https://static.texastribune.org/media/files/7019dbf9b88e56d842108a5a1acaccdb/01%20SB2%20Abbott%20Wallys%20Burgers%20MG.jpg)

Texas Gov Greg Abbott Signs Bill Designed To Limit Property Tax Growth The Texas Tribune

How To Gift Money Credit Union Of Texas

State Death Tax Hikes Loom Where Not To Die In 2021

State Taxes On Capital Gains Center On Budget And Policy Priorities

The Most Important Texas Inheritance Laws Explained Here Halt Org

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins